Budget bill: Senate adds nastier, more punitive cuts and even higher debt

JUNE 22 UPDATE: SNAP cuts break Senate rules; polls run 2:1 against the bill, and the newest CBO numbers are even worse.

UPDATE JUNE 22: GOP’s SNAP food plan cuts violate Senate rules, according to the Senate Parliamentarian, putting at least $128B at risk for in the scramble to pay for Trump’s tax cut. “While the parliamentarian’s rulings are advisory, they are rarely, if ever, ignored”—although Lindsey Graham has been working everyone up for months to do exactly that. We’ll see where this goes; the . And if you’re Trump looking for a diversion from budget discussions that may be going south, and your power is wobbly in Congress and needs a boost … well, bombing a country could do it.

UPDATED JUNE 19: The Senate is plowing ahead on the budget bill, but there are significant public headwinds. As WaPo notes, the “legislation is effectively a mash-up of multiple past GOP initiatives that, individually, had each been among the worst-polling major bills in recent history,.” The bill also includes yet another attempt (#51) to dismantle the ACA: “Republicans might remember, their last attempt to repeal the Affordable Care Act so enraged voters that the party suffered a watershed wipeout in the subsequent midterms.”

The CBO released new numbers on the impact on households of the budget bill as currently proposed, and also the household impact figuring in the current tariffs. The message is pretty clear. See current polling data at the end of this post. Overall, budget polling remains 2:1 against the budget; not even MAGAs are happy. Oh…and the new CBO numbers say the Senate additions add another half trillion dollars to the deficit. This would be an excellent time to voice your concerns to your senators and reprsentatives; links below to do that.

None of this would ordinarily slow down Trump, who is angry at Fox for not portarying the ‘real’ love Americans have for this administration. We’ll see if Congress has the need to go ahead and prove the point.

UPDATED JUNE 19: Looking at the map of affected states (below), a politcal solution shows up on how to save rural (predominantly Republican) population hospitals while ignoring safety net hospitals, may of which have been around for a long time and are therefore urban/more Democratic. Not surprisingly, that appears to be where Senate discussions are headed; read more here.

UPDATED JUNE 18: Please take the time to read and consider the massive implications of the Senate Finance Committee’s plan to passively defund rural and safety net hospitals, medical research and education, and the highest levels of care for serious illness. The reactions since the late Monday release have been explosive. Among many other articles, see:

Senate GOP leader faces pushback after members blindsided by Trump Bill.

A bad bill made worse: Senate GOP floats steeper Medicaid cuts.

The Senate wants billions more in Medicaid cuts, pinching states and infuriating hospitals.

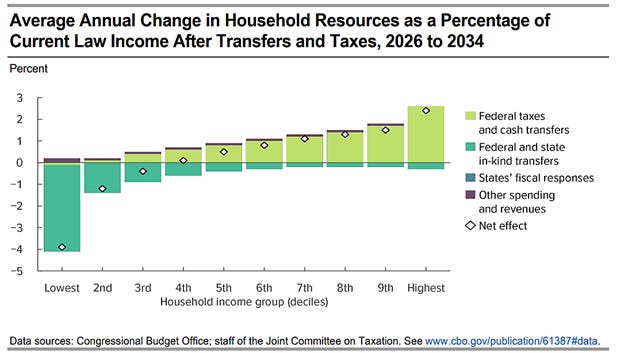

The image in this post is from the CBO analysis of the budget bill before the new Senate-proposed changes covered in this post that cut Medicaid much further, discussed below. Multiple online analyses of the new Senate version are rolling out rapidly. Do not depend on just this post—we’re working as fast as we can and will add updates, but there are bound to be omissions and errors due to Congress’ intent to get this passed quickly with limited disclosure. Also see our prior budget updates here and here for much more detail and analysis. Finally, note we’ve used some paywall-defeating links in this article; give it a minute or two if you experience delays.

Why are Medicaid cuts such a focus this year?

It would be terrific to say the cuts are primarily to decrease our record wealth gap or ballooning national debt. But as everyone in Congress knew at the start, the cuts are primarily to find the $1.3 trillion required to make Trump’s 2017 tax cuts permanent, and the only place to find that much money was always going to only be in reductions of Medicaid or Medicare, with Congress far more inclined to go to the poor than seniors. Remember, there’s a lot of data now on what the 2017 tax cut accomplished for different income brackets; we’ve covered that in prior posts. Essentially, the top 5% of wage earners ($450,000+/year) got almost half the benefit of the tax cut. This Congress is well aware of that, and determined to continue that policy. To bring the impact current, here’s what the CBO had to say last week about the impact of this new budget bill as proposed by the House before the impact of yesterday’s Senate huge new cuts to Medicaid.

The CBO considered the total impact of the bill and found:

Top earners: The top decile earners (roughly top 10%) get a “resource” increase from the tax cut of about $12,000, or about 2.3% of their projected income.

Middle income: Households in the fifth and sixth deciles would see their resources increase by $500 or $1000 (0.5% or 0.8% of projected income).

Lowest decile: Will pay—lose—about $1,600 per year, or about 3.9% of their income.

Yes, you read that right. The lowest ~10% of earners (and about the bottom third) will give up more “resources” to pay for middle income earners to get a modest bump from the tax cut and for the highest earners to get a $12,000 bump, or about 4% more income. And passing all that will increase debt at the same time; keep in mind we’re now paying more on debt interest annually than for defense.

Or, as Sen. Wynder (D-OR) says, “This is caviar over kids, and Mar-a-Lago over the middle class.”

Bottom line on the new Senate version of the budget bill

The Senate treated the House budget bill as an opening bid. The House version directly cut Medicaid by 62% ( $863B). The Senate version goes much further by slashing where our uninsured can get care of any kind and adds a trillion dollars more for debit than the House version. Because of the power dynamics between the two chambers and the GOP self-imposed deadline to get the bill on Trump’s desk by July 4, the Senate bill is more likely to become law, and quickly.

Timing

As of June 17, there are only three regular Congressional work days left before the holiday, and both the Senate and the House must vote this week to meet the deadline, although Sen. Majority Leader Thune (R-SD) is threatening to roll into the July 4 recess to get the bill on the president’s desk. They want this done, now. ***Expect this bill to move very quickly before details are clear enough for resistance and lobbying to take hold, before members can even actually read and integrate the entire bill.*** There is still scattered resistance in the Senate1 and the Senate and House can each only afford to lose three votes2. Speaker Johnson showed exactly how to force feed a bill through the House in May, giving members <24 hours to review and integrate 1,100 pages of the complete bill before the vote, which even MTG whined about for an hour or so.

CONTACT YOUR SENATORS AND REPRESENTATIVES NOW.

Most significant changes

MEDICAID

In addition to the House devastation of Medicaid—a CBO projection of an 62% increase to America’s uninsured before Senate additions—the Senate is adding a wrecking ball that will further decrease federal Medicaid funds to states. They’re proposing decreasing the amount of taxes health care providers can claim, triggering lower federal funding of Medicaid. Currently, states charge taxes to health care providers that the providers then recoup through higher Medicaid payments (known as DSH), which yield additional federal spending on state Medicaid programs. The Senate bill would almost halve provider taxes—from 6% to 3.5%—greatly decreasing the federal contribution.3

The impact of this is complex: it’s not just “reining in Medicaid abuse,” as the WSJ immediately cheered. To see the much larger impact, it’s necessary to understand the byzantine work-arounds we’ve developed in this country to provide care for the current one out of 10 Americans (about to increase by 62%) we refuse to insure, and to reimburse people and institutions for caring for them. So stick with me here for a few minutes, please.

The Senate move will most impact two types of health care the most: rural care, heavily dependent on Medicaid, and safety net hospitals, usually urban and the core of care for large regional swaths of zips codes.

Rural communities use Medicaid more than urban, for children to the elderly. This provision would hasten the already rapid rate of rural hospital closures, which are heavily dependent on Medicaid, and put pregnancies at even greater risk than our current abysmal, internationally-embarrassing maternal mortality rates. One out of three US counties is already without OB services. The further women are from care the higher their medical risk, so the more they pause over pregnancy at all (remember the record US low birth rate and theoretical desire to increase it).

Safety net hospitals—which are virtually all non-profit or public—accept all patients regardless of income. They are regional centers, serving multiple zip codes. In healthcare, safety net hospitals are the airports that can accommodate jets, not the comfy local airports that only handle private planes, much like our often-private suburban hospitals that handle first level care well but not the most serious care.

You may not regularly use a safety net hospital yourself, but for most regions, the quality of care, medical education, and research generated at safety net hospitals are a source of pride. And if you have something serious, you know they are there for you with an army of specialists, subspecialists and ultra-specialists no local hospital can afford, with the very latest research … specialty providers and research that require high volumes to exist. Those high volumes come directly from being the safety net hospital for the uninsured. When we increase the uninsured (via this bill) and then also deny our national work-around funding for their care, we are destroying both the lives and wellbeing of the uninsured and, long term, that of everyone else in the region.

Not every state would be affected by the Senate proposal, but many would. If your state is blue or green on this map, it will affect you. (Click for details/info.)

Halving the provider tax would slash the care offerings, medical training programs and research of the highest care level medical and trauma center, teaching hospitals anduniversity medical centers, and many non-profit hospitals in these states. It would undermine the research that requires large volumes of patients to conduct. High volumes are tied closely to better outcomes for all (including raising the quality bar in the community for other hospitals) and provide the teaching base for physicians, nurses, and related healthcare specialties.

Local employment will be at risk; the non-profit support and contributions these institutions give back by law to communities will be at risk. And decreasing those federal monies will in turn negatively impact medical, nursing and other healthcare education programs and medical research—long pipelines that will take years to rebuild. There are also current political benefits: This will further undermine medical scientists, educators, and researchers the current administration is bent on attacking and controlling. The method of rate adjustments also punishes predominantly blue states that expanded Medicaid under the ACA, a long-time burr under Republican fur, something they have unsuccessfully attempted to repeal more than 50 times. Those impacts alone should make you suspicious.

If passed, this would have a major impact on care in both the short and long terms. If there is time for people to actually understand the issue before the bill is pushed to a vote, there should be significant pushback.4

DEBT

Congress is also staring down a midsummer deadline to raise the nation’s debt limit, the amount of money the federal government can borrow to pay for already authorized spending. If lawmakers don’t act to increase the borrowing cap, the country faces a devastating default; with the GOP controlling Congress and the White House, they’re not going to let that happen on their watch. The Senate proposes using the bill to raise the debt ceiling by $5 trillion, instead of the $4 trillion adopted by House Republicans. We’ve also covered the hard data on that in prior posts like this one.

ENERGY CREDITS

The Senate’s version would also end the $7,500 tax credit for electric vehicles within 180 days of the legislation being enacted and calls for an end for subsidies to wind and solar and ends a credit for companies that lease rooftop solar systems as well as homeowners who buy them outright.5 The elimination of the credits would decimate the already reeling solar industry, with the uncertainty of the fate of the clean energy incentives already causing disruption in the market. Here’s what that would look like in one (red) southern state alone. The House Freedom Caucus—loud and then submissive when Daddy got mad—is deeply opposed to extending any green credits, so we’ll see where that goes.

PERMANENT BUSINESS TAX BREAKS

The Senate measure offers bigger tax benefits for corporations, proposing to make permanent a set of generous deductions for research and development and other expenses, including machinery purchases. The measures were set to expire at the end of the year, and the House had proposed to extend these measures on a temporary basis.

CHILD TAX CREDIT

The House wanted to increase the maximum benefit for the child tax credit, a tax break for families with qualifying children, to $2,500; the Senate bill cuts it to $2,200 while tying it to inflation, although the Senate bill expands the dependent-care assistance program.

GUNS AND SILENCERS (Yes, really)

A little-discussed provision in the House bill “intended to excite gun-rights advocates and outrage gun-control activists” partially repealed part of the National Firearms Act of 1934 by getting rid of a tax on silencers. The new draft of the Senate Finance Committee’s budget bill expands that, completely completely removing silencers as well as short-barrel rifles and shotguns from the NFA, eliminating taxes and requirements for registration.

SALT (State and Local Tax Deduction)

Unlike the house, there aren’t any Rs in the Senate from impacted blue states, so no Senate dogs in that fight … SALT goes back to the original $10K from the House proposal of $40K. Five bipartisan blue state House members pushed hard for a higher deduction, and the House can only afford to lose three votes, but in the final vote what will matter is that an increase would primarily benefit blue states. House members get to say they tried.

OTHER TWEAKS

As of four days ago, the Senate proposal added broadband funding that favors Musk’s Starlink and still includes the House’s ban on states passing AI laws for 10 years. The latter caused an immediate uproar when it was in the House bill. The National Law Review and more than 260 state legislators from all 50 states immediately opposed it amid Senate concerns … and then the opposition suddenly went dark. I’ve searched multiple articles about the Senate bill today and can’t find anything about the AI law; keep an eye on that. Something’s going on there.

A handful of Trump's key campaign promises would be scaled back under the Senate's version of the bill. The bill creates new deductions for taxes on tips, overtime pay and car loan interest — a priority of Trump’s that he campaigned on — but doesn’t make them fully deductible. Tips are deductible up to $25,000 through 2028 for those making <$150,000. Overtime pay is deductible up to $12,500, or $25,000 for joint filers, through 2028. Auto loan interest is deductible up to $10,000, also through 2028.

Facing what would have looked like a tax increase if the 2017 tax cut expired this year6, the Senate makes permanent several one-time … um … bribes?7 The new Senate legislation proposes granting a $6,000 tax deduction for older voter/donors Americans, up from the $4,000 deduction included in the House bill, and also a one-time $1,000 increase for individuals and $2,000 for married filers taking effect in the 2026 tax year, while their House counterparts would offer the extra amounts but only through 2028.

What’s next

Expect quick, forceful, take-no-prisoners action from the White House and the Senate, with the House squawking but falling in line. CONTACT YOUR SENATORS AND REPRESENTATIVES NOW IF YOU WANT YOUR INPUT TO BE HEARD. LATER WILL BE TOO LATE; THE PRESSURE ON CONGRESS TO ACT VERY QUICKLY IS IMMENSE.

Here’s an updated poll from KFF (June 17), although this would still not have reflected the additions from the Senate, which came out late the evening before the poll was published—meaning the survey itself would have taken place before the Senate version came out.

Bottom line: If you don’t like the way this budget bill is going, it looks like you might not be alone. Act now or deal with the impact on you, your kids, and your grandchildren for the next decade.

Sen. Rand Paul (Kentucky) has opposed the legislation because it raises the country’s debt limit. Sens. Susan Collins (Maine), Josh Hawley (Missouri), Jerry Moran (Kansas) and Lisa Murkowski (Alaska) have voiced concerns over cuts to Medicaid—but the waffling started even before the Finance Committee released their draft.

While the House can only afford three defections, the House version only passed by one vote in May. Reps. Massie (R, KY) and Warren (R, OH) voted against the House bill: here’s why.

The new meaning of “states’ rights:” Let them eat the costs the feds used to pay.

The various hospital, medical education and physician organizations will lobby against this, unfortunately at a time that science- and academic-denial is at an all-time high. If you’re at all concerned about where the 13% of state residents who will be uninsured if this bill passes will get care, this should concern you; if nothing else, consider it will certainly change the look and feel of suburban for-profit hospital patients (and emergency rooms) when the uninsured have no public option for care. And it will absolutely affect both care quality and provider education programs. Lowering the amount of provider tax claimed will have a major downstream effect on the entire community and—because of the impact on medical education—eventually everyone in these states, no matter where they receive care.

Remember: 18% of the US population is over 65, but it’s 50% of the Senate, where the median age is 64.7 years. As we’ve seen over and over with social media hearings, the Senate relies on old-school thinking. (Disclaimer: I’m a Boomer, but I don’t live in the past.)

Rep. Chip Roy (R-TX) last week on legislation that includes tax cut expiration dates: “There’s a total tax cliff in [this bill.] There’s about $1.5 trillion worth of taxes that expire in four years, five years, which means what? In five years, they’ll just keep them going. This is why we end up with the same problem … It is 100 percent a gimmick to have tax cuts that you’re putting in place for four or five years.”

Here’s money for you upfront; don’t worry about the other details on this little bill.