Plunder now, govern later...arr!

Trump's One Big Beautiful Bill Act is headed to the Senate. They promise they'll govern later. Maybe after the 2028 election...

Why this matters to women

On the one hand, your own finances may benefit—or not—from the plot. OTOH, we’re robbing half of the population now—and our grandchildren’s futures—to get there: worth considering. Plus if you or someone you love is on Medicaid, Medicare, or Social Security, there are changes in the bill—some very big.

See previous budget episodes here and here. Also, if you consider forwarding this post, understand it includes a few…acerbic…comments, sometimes buried in footnotes, that are easy for us to say but may not appeal to all. That said, feel free to

The drone view

Credit to House Speaker Mike Johnson, who somehow managed to wrangle his Freedom Caucus cowboys1 into passing Trump’s One Big Beautiful Bill Act (OBBBA) through the House by one (1) vote.

And a lot less credit for the rest of us, as Moody’s tried to warn last week.

The short version is the bill, with some bait for the masses,

Fulfills many of Trump's populist campaign pledges and extends his 2017 tax cuts that were due to expire this year. That prevents the ultimate horror of taxes appearing to increase at a time Rs are in full control.

Includes a total of $300 billion for immigration control and defense, including a $25 billion downpayment for the Golden Dome.2

Overall, it’s estimated to add less than originally estimated to the debt, $3.8 trillion over 10 years,3 while increasing the nation’s uninsured by up to 50%, also (amazingly) less than in original proposals.

Now it’s on its way to senators who only three days ago made sure we know user experience will vary when they proactively carved out the tax exemption for tips included in the bill before it even passed the House.4

If you want the True D version of the bill, Robert Reich gets quickly to the point as always in his Substack post, “What you need to share about the “one big beautiful” ugly horrible bill.” He references data from MarketWatch, the CBPP, the CBO, and a Wharton analysis, and we’ve included Wapo’s analysis and other tidbits.

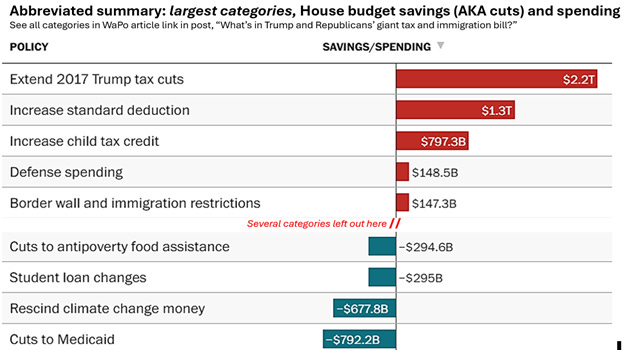

The Washington Post budget analysis is gifted here—no paywall. When it’s referenced below, pop back here for the article itself. Some good details there about specific budget categories.

Summary sections

The governing dilemma no one wants to talk about.

Impact on the deficit, MediCAID, and potentially MediCARE, and current winners and losers.

What’s next.

Klarna governing: Plunder now, govern later

This is the context few are talking about, but if we’re really patriotically inclined—committed to the country’s future and a greater good for all, not just our own tax rates—we need to be. It’s tomorrow’s problem for some other administration and our kids to deal with, and it’s massive.

While S&P and Fitch had already lowered the US credit rating, Moody’s hung on until they couldn’t. Last Friday, for the first time in history, Moody’s downgraded the US from the gold star rating of AAA to AA1, putting us in the company of precious few peers.5 It was a last-ditch effort to warn Congress the US is on an unsustainable fiscal path, eroding power at a time of intensifying great power competition—mortgaging our liberty and world leadership with excessive borrowing. The guiding principle in DC appears to let some other administration—hopefully Democrats (wink wink)—handle the bankruptcy and restructuring. The zebra’s stripes haven’t changed.

Click for CBO projections that US debt will reach 156% of GDP by 20556 and click here for the anxiety-inducing US debt clock.

Economist Heather Long nails it: “For me, the real panic was when Moody’s spelled out how much of our federal revenue will soon be going solely to interest payments on the debt: It was 9 percent in 2021. It jumped to 18 percent in 2024. By 2035, Moody’s estimates almost a third of revenue will go to interest payments. The typical AAA-rated nation has less than 2 percent of revenue going toward interest.” She predicted mortgage rates would climb to 7 percent again. The average US interest rate has already increased to 7% with the U.S. dollar still down about 8 percent this year.

As Reich points out, anyone buying anything on interest pays: all of us, in both our tax payments and higher interest rates for mortgages and all other long-term borrowing, essentially leaving already financially stressed Millennials and Gen Zs, and following generations, to donate a third of their revenue to paying national debt interest.7

Or as one of the lone R holdouts said, “This bill is a ticking time bomb…[It] dramatically increases deficits in the near-term, but promises our government will be fiscally responsible five years from now. Where have we heard that before?”

“Not my problem” indeed.

What’s in the bill?

The very short version follows. See the WaPo article above for detail, including under-the-radar changes like decreasing medical student loan availability and an interest deduction on new 85% US-made cars like—surprise!—two Tesla models. The deduction mysteriously almost exactly neutralizes the tariffs on generally less expensive foreign cars. There’s even a conversion of the ‘baby bonds’ proposal from Dems Cory Booker and Ayanna Pressley that they couldn’t get passed; it’s now ‘Trump accounts.’ (Ouch.)

MediCAID cuts are around $800B in total; that will kick about 9 million enrollees off after it takes effect a month after the midterm elections. (Clever, that.) There are about 26M uninsured right now in America, so we’re looking at increasing the uninsured numbers by a third with 2027 Medicaid cuts, but actually more than 50% with intended-to-be-impossible work requirements. That’s huge: ask any hospital or doctor.8 If you know someone on original or expanded Medicaid, help them prepare now.

History says the party that interferes with healthcare coverage takes a hit in the following election, so—proving they’re wide awake in Congress—the Medicaid hit is scheduled to start the month after the 2026 midterms (December 2026).

On top of that, there is another $270B in cuts to SNAP food assistance. The US already has the highest percent of children living in poverty of OECD countries, astounding all by itself. One out of five US kids lives in hunger; find an excuse for that in the theoretically richest country in the world—the same country that wants people to have more kids, BTW. OBBBA cuts put 14M kids at risk: 20% of our 74M kids. If you’re one of the 80% of teachers who are women, you likely fight this every single day; hungry kids can’t learn.

Largely unnoticed for now is a Medi*CARE* hit of $490B under current rules that require sequestration (compulsory budgetary reductions) due to the almost $4T hit to the deficit…unless, of course, Congress changes the rules. That may also be what the $4000 senior tax deduction in the House bill aims to counter. Everyone on the Hill knows allowing cuts to Medicare would come with dire political consequences, so something will give.

But it is going to be beautiful for some; you just need to be in at least the top 10% of income earners. Then you’ll get an income boost from the bill of 4% in 2027 and 2% in 2033. By contrast, the CBO estimates income for the bottom 10% of households would fall by 2% and 4% in those years with this bill.

Here’s how some brackets will be affected; see Reich and the Wapo article for more examples, and click here for the CBO analysis.

60% of the tax cuts would go to the top 20% of households, with 45% of the benefit to those making at least $460,000 (the average of the top 5%) this year.

Within the top 5%, the biggest beneficiaries by percent cut will be households making between $460,000 and $1.1 million (the top 95th to 99th percent of income). The bill would cut their taxes by an average of nearly $21,000, or 4.3% of after-tax income

In dollar terms, the biggest winners would be the top 0.1% of households, those earning more than $5 million annually. Their taxes would be cut by an average of almost $300,000, or about 3.3 percent of their after-tax income. Trump cabinet and high level execs who are well above this category include, in addition to Trump, Musk, McMahon, Lutnick, Bessent Burgum, Loeffler, Isaacman, Witcoff…the list goes on and on.

It’s hard to tell about Congress, but back in 2007 the median net worth of senators was a million, ~$1.5M in today’s dollars. But that was the median, so 50% were above that. Once that info was published in 2007, the data got locked down a lot better; no one’s been able to penetrate it since.

What about the almost 4 out of 10 American households bringing in under $50,000/year, which equates to about $25/hour or less? If you figure in the benefit cuts and the tax cuts, they’ll lose about $700 a year. And if they make less than $8.50/hour (~$17,000/year), they’ll lose more than $1,000 per year on average. Trickle-up economics in action: a third of the population paying for tax cuts for everyone else. Note around $50,000/year is where many of our childbearing-age generations are—you know, the ones we want to have more babies.

What happens next?

On to the theoretically adult section of Congress, the Senate.

GOP leaders are using the budget reconciliation process to shepherd the measure, which would allow them to dodge a Democratic filibuster in the Senate and pass it on party lines. Overall, the largest issues will likely be the extent of the tax cut—the largest driver on the new debt—and how much Medicaid will be hit, but there are plenty of other targets as well. The Hill says there will be a “swarm of objections.” The New York Times says senators, “never of a mind to let the House take the lead,” are basically lying in wait with plenty of ideas on changes. (Gifted article—no paywall.)

Here’s what Sen. Rick Scott (R) has to say about the bill. He’s one guy who knows how to work government: As CEO of Columbia-HCA, Scott led the company to the largest-ever Medicare corporate fraud penalty at the time and 14 felony convictions.9 Lindsey Graham isn’t happy; that should last at least 10 minutes. Rand Paul, always a paragon of team play, already says he’s a hard no. After interminable meetings and photo ops featuring furrowed brows, serious looks, and govern-ish pronouncements, eventually the Senate will—however reluctant they seem—give Caesar his version of his due. Definitely best to keep a careful eye on events.

One suspects Johnson’s successful wrangling of the Freedom Caucus makes Kevin McCarthy crazy. They were McCarthy’s ultimate undoing, and Johnson has repeatedly managed them with Daddy available for last-second spankings. So much for the Caucus’ grandstanding about the terrible sin of debt.

The defense spending includes $25B to start Trump’s Golden Dome missile defense system, about which China is already unhappy and Canada is said to want to join in. Trump says the system will cost $175B and be completed before 2028 elections. The CBO initially said it would cost $831B, but now estimates the cost between $161 billion and $542 billion over 20 years, depending on factors like launch costs and the number of interceptors. This is all pretty new, and given the cost and completion history of the big beautiful wall, we can count on discussion about this going on for a while.

Before interest. But that still beats—I guess—the originally estimated hit of up to $6 trillion plus interest on top of our current $36.2 trillion debt.

It took naive me a few cycles of corporate budgeting to figure out you just propose more than you want to elicit the predictable howling, then back off to the number you’d originally targeted anyway. Win-win. But surely The Government doesn’t function like that, right?

AA1 peer countries include Austria and Finland. Peer countries with the higher rating (AAA) we lost: Canada, Germany, Denmark, Norway, Singapore, Sweden, Australia, Switzerland, and the Netherlands. See a rating chart here.

You’re on your own if you want the “All glory to Ceasar!” version, although you could start here.

Let’s hear it for trickle-down economics, first employed during the Great Depression by Herbert Hoover, which, with WWII spending, led to a record high debt:GDP ratio of 106% by 1946. The debt was then intentionally strategically reduced over the following decades to a low of 31% by 1980, when Ronald Reagan was elected and brought the concept back. In only four decades since, the debt has quadrupled to the current all-time high of 124% of GDP.

We all end up paying when charity care increases. Hospitals address lost revenue from uninsured patient care through several mechanisms, including government funding, additional payments from Medicare and Medicaid (which comes to us eventually as tax increases), increasing charges to other insurance (which eventually hits our own costs), and by charging other patients more, increasing personal debt. And the hit will be far worse at rural hospitals; rural populations are more dependent on both Medicaid and Medicare, with budget cuts. Already, over 1000 US counties are ‘medical deserts’ with no hospital care. See more here on hospital financing of charity care, and more here about growing rural hospital financial issues.

Not to worry. Columbia HCA ultimately paid $1.7B in fines and said it made mistakes but pledged to take responsibility, so it’s OK. They gave Scott a $10 million reward severance package, about $17 million in today’s dollars. He’s a man of the people; just ask him. (Have we mentioned we’re not admirers?)